For over a century, International Women’s Day, which holds on 8 March each year, has always marked a day of celebration and advocacy for women’s rights and equality worldwide. This year’s official theme (2021) is #ChooseToChallenge, a call-to-action to challenge the status quo by raising awareness against bias and celebrating women’s achievement and taking action for equality.

As an organisation promoting #ChooseToChallenge and further encourage women in taking a step toward financial inclusion, we reached out to some of our female users to share their perception about savings, investment and why women should tap into the big field of financial freedom to enhance their financial well-being, ultimately building a financially stable future.

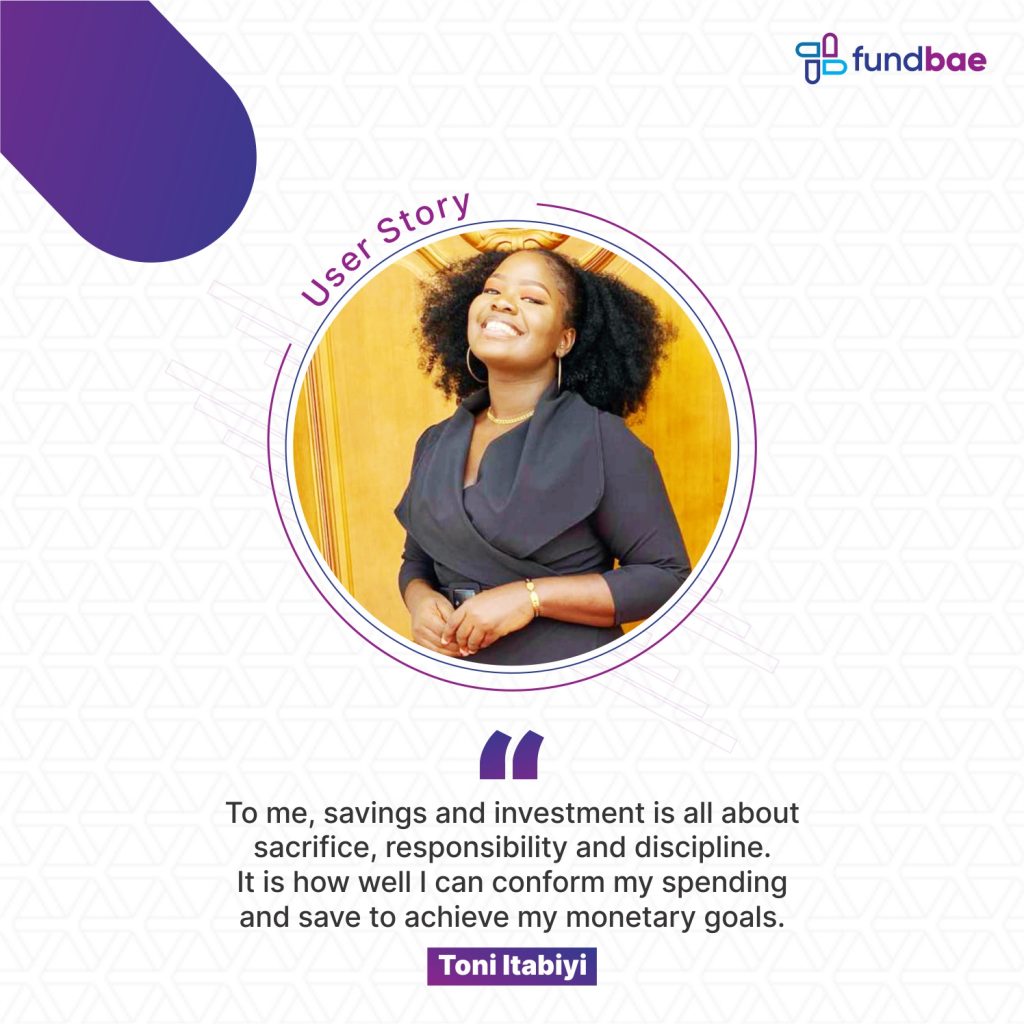

A Content Creator for one of the top leading Media Agency in Nigeria, Toni Itabiyi shares her insight into her saving. She says, “To me, savings and investment are all about sacrifice, responsibility and discipline. It is how well I can conform my spending and save to the plans I have set to achieve my monetary goals.”

“When a woman saves or invest, it helps her to be confident, independent and financially capable of satisfying all her needs. Therefore, for me to become completely independent and enjoy a happier and healthier life, I must prioritise my financial security above anything else.”

She further stressed the need for women to start saving now because there is no better time. “Saving and investing is the key to financial freedom, and if you haven’t started saving, now is the time to start”, she added.

Faith Ogedengbe, a Solar Project Finance Analyst at CMR Group, France, says, “I see savings and investment as an opportunity to have access to more money. I always remind myself that earning a salary is not the only way of making money. I can use the money I earn from working to achieve more by investing directly in a business, real estate or a financial instrument”.

Still narrating her perception, Faith says saving and investing actively helps to increase her net worth. “I’m saving in an interest yielding vehicle; either a short-term goal or long-term investment is aimed at increasing my net worth. This helps me to have more access to anything I may want or need. The freedom to have access to anything I want or need is determined by my level of savings and investment.”

Also, narrating why women should be financially free, she said, “As a woman, I believe taking steps towards achieving financial freedom through savings and investment is especially important. I recognise that being financially free will enable me to live life on my terms, give me the independence of making decisions that could shape my life, allow me to push beyond the limits that society has put around women and help me support important causes to me. This is why I constantly try to equip myself with the knowledge of investment platforms and take advantage of such platforms that make it possible to earn more income.”

Grace Ogundiran, a Digital Marketer/Product Designer, sees savings as an avenue to meet emergencies or plan towards a future goal. “Personally, I save money for emergencies and to tap into investment opportunities. I invest money to achieve long term goals. It more like using my money to buy an asset that I will generate good returns over time.”

Answering the question of why should women tap into it for financial freedom, she says, “Financial independence is not about how much money someone has. It’s about making the right decisions with the money one has at one’s disposal. Financially independent women can contribute to the household’s everyday expenses and meet their financial goals. If all women tap into savings and investment, there’ll be growth in collectively gender-wise.”

Lastly, Felicia Osho, a photographer and a content creator, says, “I save to have good financial backing. She also narrates that financial freedom is a big deal for women”

“Women should be more concerned about savings and investments. No matter how much money you make, one need to maximise what you spend money on, and the only way is to live below your means, but within your needs.”

In conclusion, to become completely independent and enjoy a happier and healthier life, women must prioritise their financial security over and above anything else. Women are strong in their budgeting skills; they successfully manage their household finances and save money. The future demands women to become more proactive at generating investment-driven savings compared to men.