Building security in the midst of rising costs

In today’s economy, earning enough to live comfortably feels like a luxury. Salaries often barely cover bills, rent, transport, groceries, and those small emergencies that always find a way to show up. In times like this, the idea of saving or investing can feel out of reach, almost like advice meant for people living a different reality.

And honestly, that’s understandable. Saving feels easy only when income exceeds expenses or when responsibilities are lighter. But for most people, every naira already has a destination—food, rent, bills—leaving little room for anything else. Many aren’t trying to build wealth right now; they’re simply trying to stay afloat. When money is tight, you want it close, not locked away.

Still, even in the middle of inflation and endless expenses, saving matters. Life is unpredictable, and an emergency fund can prevent a crisis from becoming a disaster. Beyond emergencies, saving helps fund personal goals, build a future, and create a bit of ease for tomorrow.

At the same time, relying on just one source of income increases financial pressure. That’s why exploring additional income streams such as side hustle, freelance work, or a small business is valuable. Even if the returns aren’t huge, they reduce dependence on salary and make it easier to set something aside for savings or investment.

Balance is key. Keep funds accessible for daily needs, but still commit to saving a small, consistent portion for emergencies or long-term growth. It might feel insignificant now, but over time, it becomes a safety net that protects you when you least expect it.

And while building financial security, stay cautious. Be wary of schemes that promise unrealistic, quick returns. In tough times, those offers can look tempting, but a true safety net should protect you, not put you at risk.

The economy may be tough, but we can do more than just survive. By saving intentionally, even in small amounts, and finding ways to earn a little extra, we build the financial buffer that gives us breathing space and peace of mind.

NOW TO THE NEWS

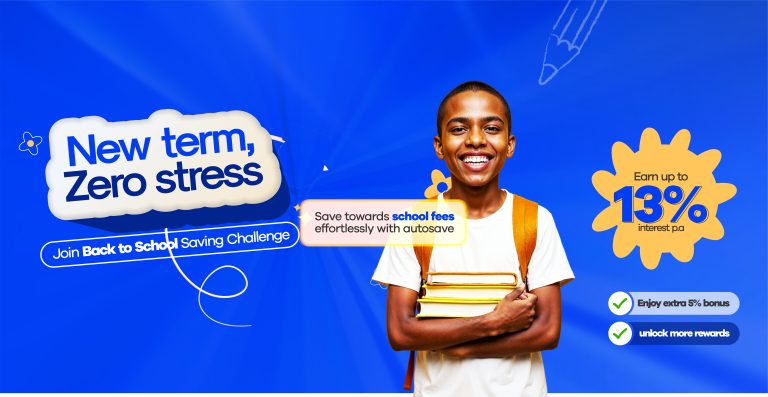

Vale Reminds Users to Join the Millionaire Savings Challenge

At Vale Finance, we are helping users build wealth with intention through the Millionaire Savings Challenge, a goal-based savings Challenge designed to help users hit or exceed the ₦1,000,000 savings milestone with ease and discipline.

Participants can save consistently while earning up to 13% interest per annum on their balance. In addition, users who complete the challenge receive an extra 5% bonus on interest earned, making the journey to one million even more rewarding.

The challenge runs until 30th December and is open to both new and existing Vale app users. Don’t miss the opportunity to save with purpose and become a Millionaire.

Nigeria Removed from FATF Grey List, Boosting Investor Confidence

The Financial Action Task Force (FATF), announced on Friday that Nigeria has been removed from its grey list, ending nearly three years of being classified as a high-risk jurisdiction for money laundering and terrorist financing. The move is seen as a positive signal for investor confidence in the nation’s economy.

Nigeria was delisted alongside South Africa, Burkina Faso, and Mozambique, following sustained efforts by these governments to strengthen measures against money laundering and terrorist financing.

The countries had been added to the grey list at different times: South Africa and Nigeria in February 2023, Mozambique in October 2022, and Burkina Faso in February 2021. Their removal reflects improved compliance with global financial standards and anti-money laundering protocols.

Overall, Nigeria’s exit from the grey list marks a significant step in enhancing its reputation in the global financial system, potentially attracting more foreign investment and reinforcing confidence in the country’s regulatory environment.

Naira Strengthens to ₦1,455.5/$1 Amid Improved Market Stability

The Naira closed the week stronger at ₦1,455.5 per US dollar on Friday, according to data from the Central Bank of Nigeria (CBN). This is an improvement from Thursday’s rate of ₦1,461/$1, reflecting a trend of relative stability in the foreign exchange market. Earlier in the week, the currency showed resilience, closing at ₦1,462/$1 on Wednesday and ₦1,464.5/$1 on both Monday and Tuesday, indicating modest but consistent gains.

In the parallel market, the Naira traded between ₦1,487/$1 and ₦1,492/$1 throughout the week, highlighting a persistent gap between official and parallel rates.

Week-on-week, the Naira appreciated by about ₦15.5, or roughly 1%, compared to last week’s closing rate of ₦1,471/$1. This follows a similar trend the previous week, suggesting a broader pattern of gradual strengthening in the currency.

Analysts attribute the improved performance to factors such as increased dollar inflows, enhanced CBN liquidity interventions, and stabilizing investor confidence in the government’s ongoing monetary reforms.

Nigeria’s Foreign Reserves Hit $42.8 Billion, Highest Since 2019

Nigeria’s foreign exchange reserves rose to $42.8 billion, up from $42.79 billion earlier in the week. This marks the highest level since September 12, 2019, when reserves stood at approximately $42.84 billion.

The steady increase in reserves reflects improved foreign inflows and prudent reserve management by the Central Bank of Nigeria (CBN). Analysts say this provides a stronger buffer to defend the Naira against external shocks and supports overall macroeconomic stability.

With the Naira posting consistent gains and reserves trending upward, market observers remain cautiously optimistic about the local currency’s trajectory.

Sustained fiscal discipline, transparent FX management, and ongoing structural reforms are expected to further strengthen the Naira in the coming weeks, reinforcing confidence in Nigeria’s foreign exchange and economic outlook.