Consistency is the Foundation of Building Wealth

Building wealth is what many of us dream about and speak about, because we want to break generational cycles and have that soft life. Truth be told, the desire is valid. Nobody wants to work tirelessly and still be stuck in survival mode. We all want ease, peace of mind, and the kind of money that makes life feel better.

We often treat building wealth like starting a gym routine. At first, we’re motivated: we buy new workout clothes, sign up for classes, and are eager to begin. Then, we skip one session. One session becomes a week, then a month, and eventually, we stop altogether. That is how some of us approach saving and wealth building. We start strong and excited, even declaring out loud, “This year, I’m saving consistently”. However, before we know it, we pause and tell ourselves we’ll continue next month. Just like with the gym, that pause turns into a full stop and then we wonder why nothing changes.

Let’s be honest, wanting to build wealth and actually doing it are two different things. If we are being real, you can’t say you’re building wealth without consistency. Wealth isn’t built by talking about it, or by saving only when you feel like it, or investing because it is trending. It requires consistency.

At times, we say things like, “once I earn more, I’ll start saving properly,” or “how can I save when this money isn’t even enough?” …or even “Abeg, I can’t come and die, let me enjoy small”. These are valid feelings. Life gets hard. Still, wealth doesn’t wait for perfect conditions. It is built from habits, often uncomfortable habits, and discipline. It takes discipline to save before you spend. You won’t magically become a disciplined person when more money comes in. You become that person by building wealth now, with what you have.

There are moments when it feels like you are punishing yourself. You’ll wonder if it’s even worth it. You’ll tell yourself, “Let me just pause this month, I’ll pick it up again next month,” or “This one I’m saving, is it not just to spend it later?” And that’s how the cycle starts. One skip becomes two, and before you know it, you’re back to square one.

Think of building wealth like building a house: Habit is showing up to lay one brick every day. Discipline is showing up even on days you’re tired, busy, or it’s raining. Consistency is what happens when you keep laying those bricks, day after day.

In essence: Habit + discipline = consistency.

Consistency is what keeps the vision alive when motivation fades. It’s what turns small beginnings into something tangible. So, before you go all about “building wealth”, pause and ask yourself: Am I willing to build a saving habit? Am I disciplined enough? Can I stay consistent enough to fulfil this dream?

In the end, building wealth isn’t a one-time decision, it is a daily commitment. Because you don’t rise to wealth, you build it, brick by brick. And what holds it all together is consistency. So, if you’re serious about building wealth, show it not just in words, but in actions, and consistency.

NOW TO THE NEWS

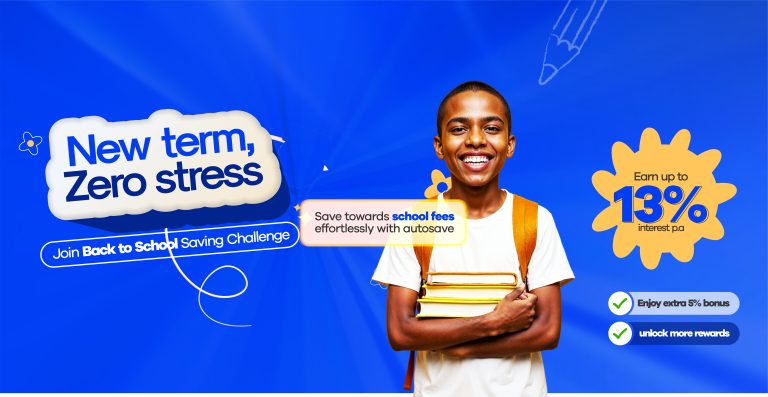

Vale launches Savings Challenges with even more rewards

At Vale Finance, we are turning smart money moves into a fun, rewarding experience with our new saving challenges, designed to help customers save smartly while still enjoying life. The new challenges: Summer Challenge, Millionaire Challenge, Back to School Challenge, and Detty December are designed to help our users save towards these key seasons and goals

These challenges offer an opportunity to put money aside for both long and short-term needs such as school fees, travel, or even working towards saving that first million, while earning extra rewards.

The thrilling part is, participants stand the chance to earn up to 13% interest on their savings, plus an extra 5% bonus, making it not just a smart way to save but also a chance to earn more value for their money. The goal-based saving challenges are available to both new and existing users on the Vale app. It’s all about helping more people save with purpose and earn while at it.

CBN halts dividends, bonuses, and foreign investments for banks under regulatory forbearance

The Central Bank of Nigeria (CBN) has issued a new directive instructing banks currently operating under regulatory forbearance to suspend dividend payments, defer executive bonuses, and halt new investments in foreign subsidiaries or offshore ventures. This move is aimed at strengthening capital buffers and promoting financial stability within the banking sector.

The directive applies specifically to banks that are under regulatory forbearance due to breaches such as excessive credit exposures or violations of the Single Obligor Limit (SOL), which indicate financial stress. The CBN emphasized that these restrictions will remain in place until it can independently verify that the affected banks meet the required standards for capital adequacy and provisioning.

According to the CBN, this supervisory measure is designed to ensure that affected banks retain internal resources to meet obligations and rebuild financial resilience. The central bank is focused on ensuring sound prudential positions are restored before these banks can resume normal operations such as dividend payments or offshore investments.

This development comes amid a broader recapitalization effort in the banking industry, where new capital thresholds are being introduced in phases until 2026. Analysts suggest that the CBN’s stance reflects a shift from offering relief measures to enforcing financial discipline, especially in the face of rising inflation, exchange rate volatility, and sectoral credit risks.

Naira falls to ₦1,554/$ in official market, strengthens to ₦1,595/$ in parallel market

The naira ended the week with a mixed performance across the foreign exchange markets. While it strengthened slightly in the parallel market, it depreciated in the official market.

On Friday, the naira closed at ₦1,554/$1 in the official window, down from ₦1,545/$1 on Wednesday and ₦1,540/$1 on Tuesday, marking a full week of depreciation. During Friday’s trading session, the naira fluctuated between ₦1,537/$1 and ₦1,570/$1, with an average rate of ₦1,551.85/$1.

In the parallel market, however, the currency showed signs of recovery. It traded at ₦1,595/$1 on Friday, up from ₦1,610/$1 on Wednesday, after a slight dip to ₦1,600/$1 on Tuesday. Against the British pound, the naira weakened slightly, moving from ₦2,145/£1 on Wednesday to ₦2,148/£1 on Friday.

CBN to offer N162bn worth of Treasury Bills in upcoming auction

The Central Bank of Nigeria (CBN) will conduct a Treasury bills auction on Wednesday, offering a total of ₦162.02 billion across the standard 91-day, 182-day, and 364-day tenors. The auction is part of efforts to manage liquidity and refinance ₦27 billion worth of maturing Nigerian Treasury Bills (NTB).

Market analysts expect the discount rates to ease at the upcoming auction, citing robust liquidity levels within the financial system and an outlook of continued disinflation throughout the first half of 2025.

According to Cordros Capital Limited, investor demand may lead to a slight tapering in rates. Investor interest has leaned toward longer-term instruments in recent sessions, leading to fluctuating spot rates in the Treasury bills market. Yields have moderated in response to sustained demand for naira-denominated assets. Strong liquidity conditions have also contributed to the resistance against rising rates.

Meanwhile, activity in the Nigerian Treasury Bills market remained relatively light over the past week, with limited interest recorded in both Open Market Operations (OMO) and NTB maturities. Focus is now shifting to the upcoming auction, as investors look to capitalize on expected returns and favorable market conditions.