In this current economy, we can both agree that managing your finances and setting a monthly budget can be challenging. An individual can also be overwhelmed with where to start.

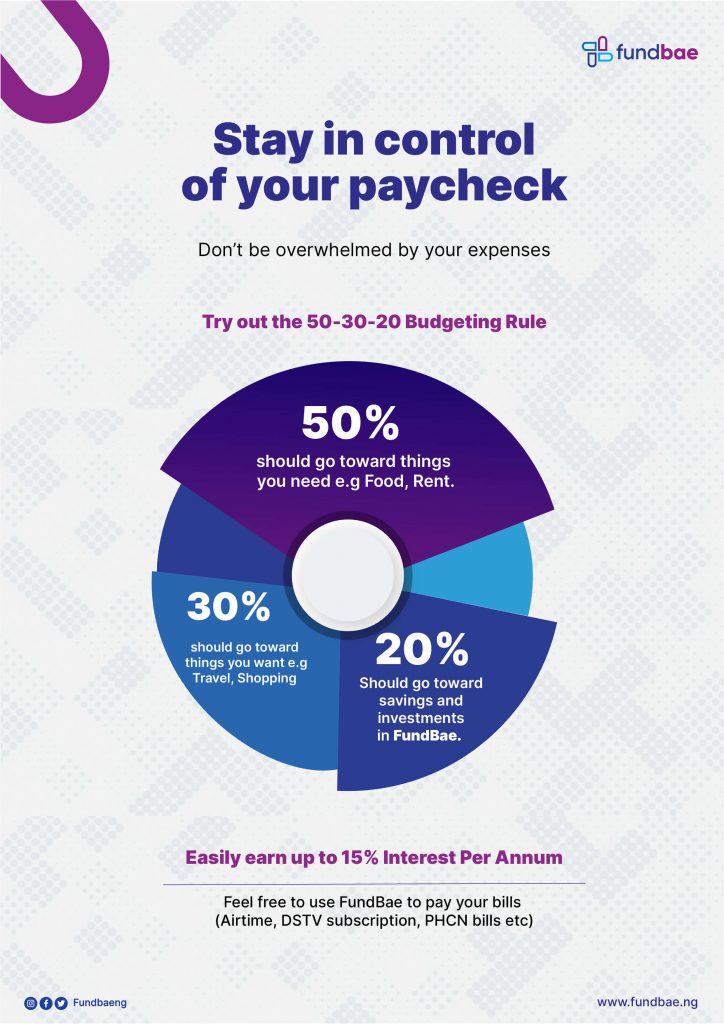

However, the 50-30-20 strategy can simplify the process. The plan divides your income into three broad categories: necessities, wants, and savings and investments. Here’s a closer look at each.

In the book ‘All Your Worth: The Ultimate Lifetime Money Plan’, Sen. Elizabeth Warren popularized this rule (a Harvard law professor) and her daughter, Amelia Warren Tyagi. It was designed as a rough rule of thumb for working-class families to plan their spending to prepare for the future and unforeseen circumstances.

Here is how to use the budgeting rule:

50% should go toward things you need

Needs are what you can’t live without, or at least very quickly. They include things like:

- Rent

- Food/ Groceries

- Utilities, such as electricity, water etc

20% should go toward savings and investments

This category includes liquid savings, like an emergency fund, retirement savings and any other investments. Experts typically recommend aiming to have enough cash in your emergency fund to cover between three and six months’ worth of living expenses.

30% should go toward things you want

This final category includes anything that isn’t considered an essential cost, such as travel, subscriptions, dining out, shopping and fun.

In conclusion, there isn’t a one-size-fits-all approach to money management. Still, the 50-30-20 plan can be an excellent way to start if you’re new to budgeting and are wondering how to divide up your income.